Five moments in your day to complete your Course Experience Survey

Course Experience Survey (CES) is now open. Here are five moments in your day to complete the survey.

Tell us how you really feel – Student Experience Survey

We know what you’re thinking already, that the thought of doing (another) survey might not sound super exciting, BUT did you know that the Student Experience Survey (SES) is one of the best ways that students can improve their experience at RMIT?

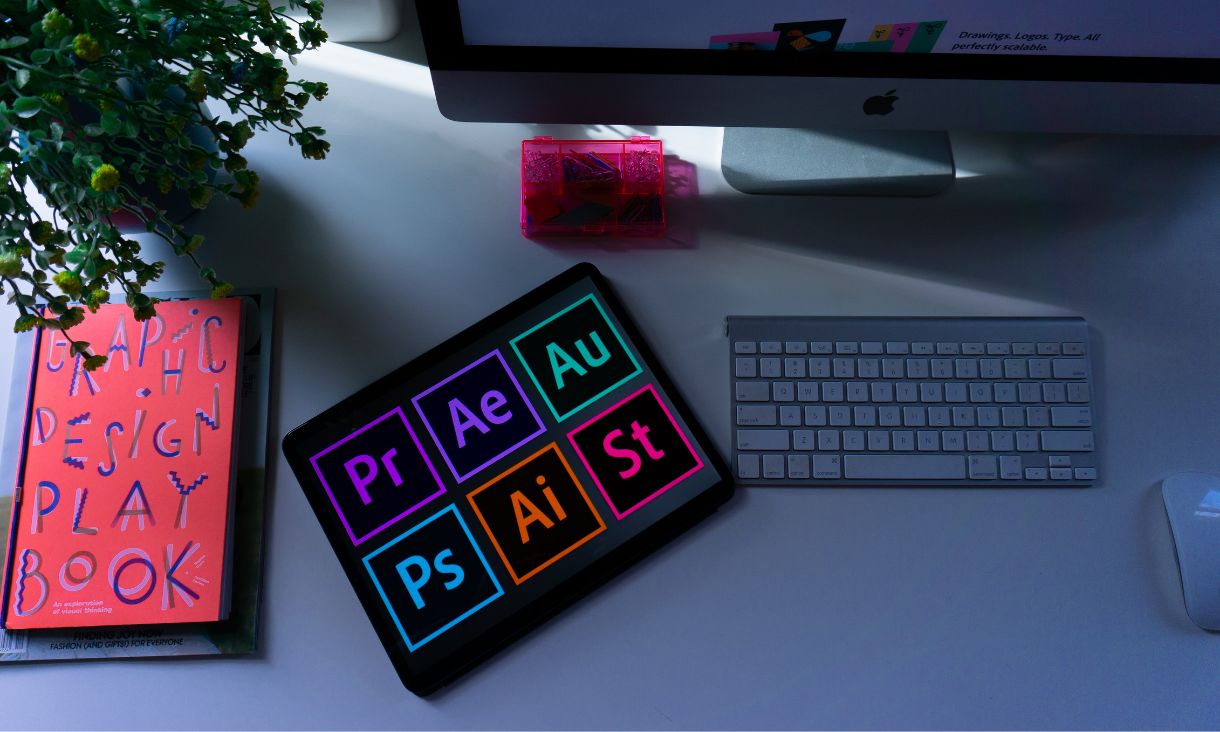

Take your assignments and career to the next level using Adobe

Learn from Adobe coaches about how to use the Adobe suite to help create professional-standard content, improve your digital skills and find out what career options can be opened for you through the Adobe suite.

Celebrating Our Graduates - Biba Brownlie

Biba Brownlie (they/them) has just graduated with a Certificate IV in Youth Work. In the meantime, Biba is studying a Bachelor of Arts (Psychology/Sociology), while they also work as a Youth Worker at Orygen.