Taking the UNIQLO experience to the next level: RMIT students pitch ideas to clothing giant

Last semester, 80 RMIT Impact Academy students in the College of Business and Law were challenged by UNIQLO with an industry-embedded business project in the semester’s Impact Academy course.

Internet use grows in remote First Nations communities, but cost still a barrier

A new report shows internet access in Australia’s remote and very remote communities improved in the past two years as 4G, Wi-Fi and satellite infrastructure is bolstered across regional Australia.

RMIT researchers help build climate-resilient housing in rural Bangladesh

Researchers from RMIT have partnered with the Palli Karma Sahayak Foundation (PKSF) in Bangladesh to build 40 sustainable and resilient housing solutions for vulnerable rural communities.

RMIT success at Victorian Premier’s Design Awards

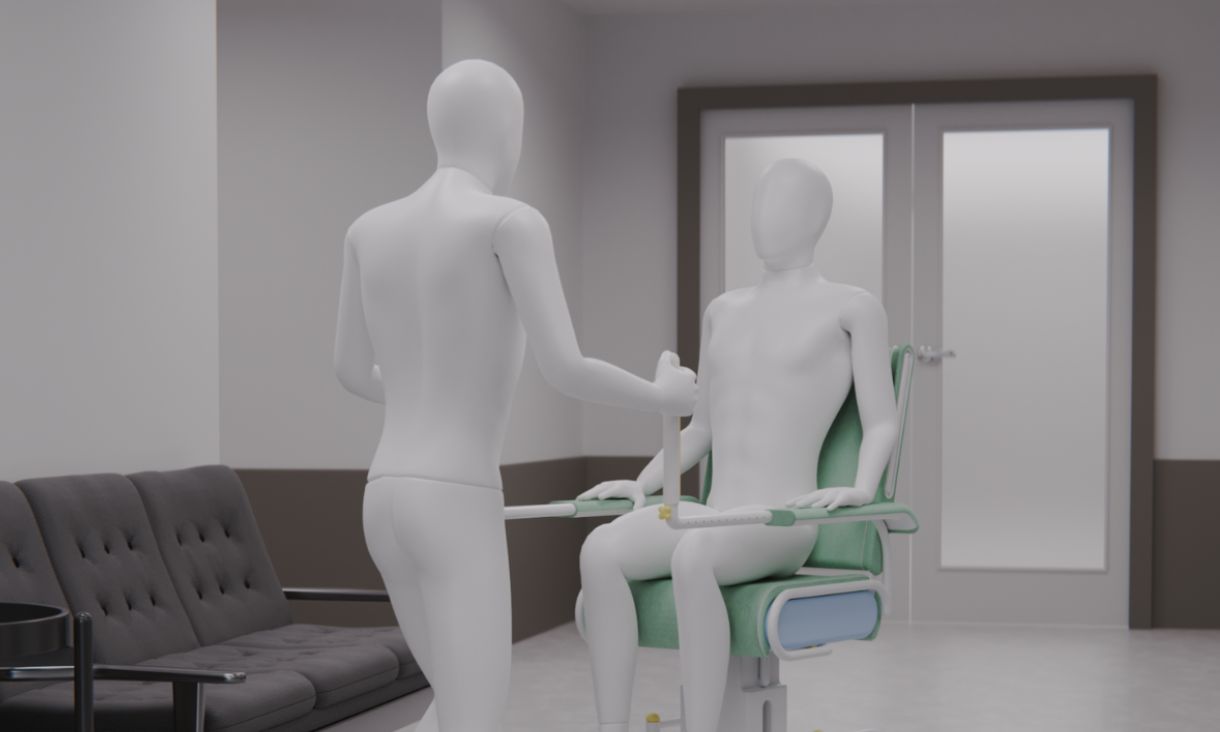

An innovative bi-directional hospital transfer chair that facilitates seamless attendant-facing transfers has won a Victorian Premier Design Award alongside recognition for a more than dozen RMIT-affiliated projects.