We had representatives from an enterprise launchpad specializing in sustainable start-ups, a group of innovators focusing on blockchain use cases, and an environmentally conscious blockchain commodities trading platform with a charitable angle. This type of event, one of many such gatherings, is becoming increasingly popular as our economy looks towards balancing the monetization of Web 3.0/Industry 4.0 technologies with that of care for the environment. The composition of such assemblies provides the general public with a view of how mainstream investments are evolving in that the pursuit of returns are now accompanied with a desire for some yield from engaging in some “greater good”.

This is one of the many developmental trajectories of innovation within the investment world that has seen progression from socially-responsible investments (SRIs) and impact investing into more contemporary ESG investing. ESG investing is essentially a process of investing in corporations based upon their ESG scores. ESG is an acronym for Environmental, Social, and Governance, and is a single metric that conflates these three large dimensions so that investors, the market, and society at large have a means by which to assess the “greater good” that a firm is “supposedly” providing. “Supposedly” only because this single measure is attempting to capture some extremely complex issues, but also is exposed to manipulation contingent upon the data that goes into its calculation. There are, for example, some succinct explications of ESG values incorporating disinformation from carbon fraud, and hence any form of ESG investing is then also susceptible to such deception. Such corporate trickery or dishonesty is more commonly known as ‘greenwashing’ and it is where firms disseminate disinformation that portrays the entity as environmentally responsible. Examples of greenwashing can range from exaggerating the environmental credentials of a particular product or initiative, to outright deception of the public in terms of firm activities.

Of concern is the scale and increasing frequency of discovery of these greenwashing activities amongst some of the largest firms, globally, but also the extent to which these greenwashing activities impact the perception of firms in light of ESG investing. For one, it is possible that the greenwashed data is sufficiently believable that it gets incorporated into the ESG score, which then distorts the core metric that individuals or the markets may use in their investment decision-making. Moreover, such greenwashing information distortions can be visualized as ripples in that they can have an impact in areas far removed from its origins thus creating misrepresentations of prices. Put simply, it is possible that these greenwashing activities make a market more inefficient and that any corrections can have wider impacts in both the short- and medium-term.

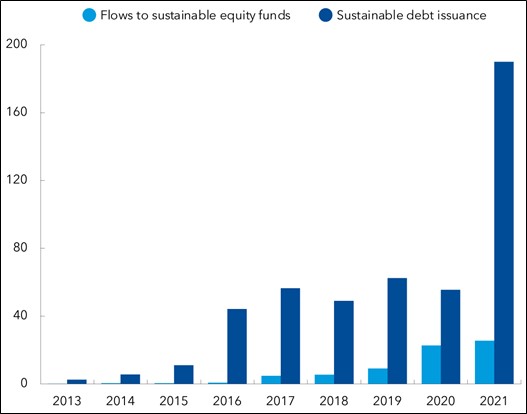

This is concerning because the appetite for ESG or some notion of responsible investing is growing. Recent statistics published by the IMF highlight that ESG-linked borrowing more than tripled over the past year with ESG investments now making up almost 18% of foreign financing for emerging markets, excluding China. Moreover, recent data from Morningstar also highlights the considerable growth in in ESG funds with an estimated asset valuation of $2.7 trillion in 2021.

Figure 1: Sustainable-debt issuance in emerging economies in billions of $US (source: IMF Blog, 2022)