What needs to be done

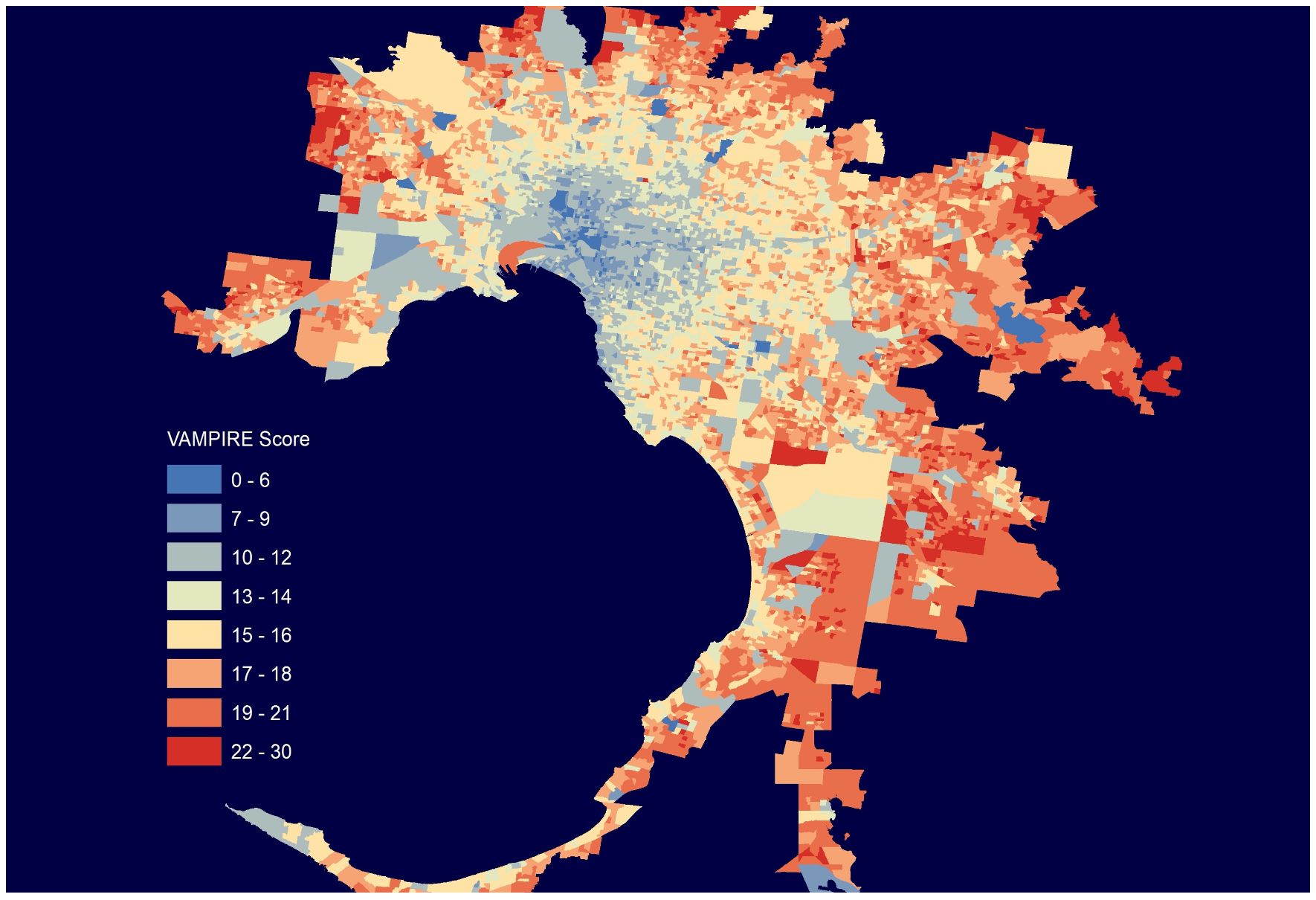

So what what would be a less regressive response to higher fuel prices?

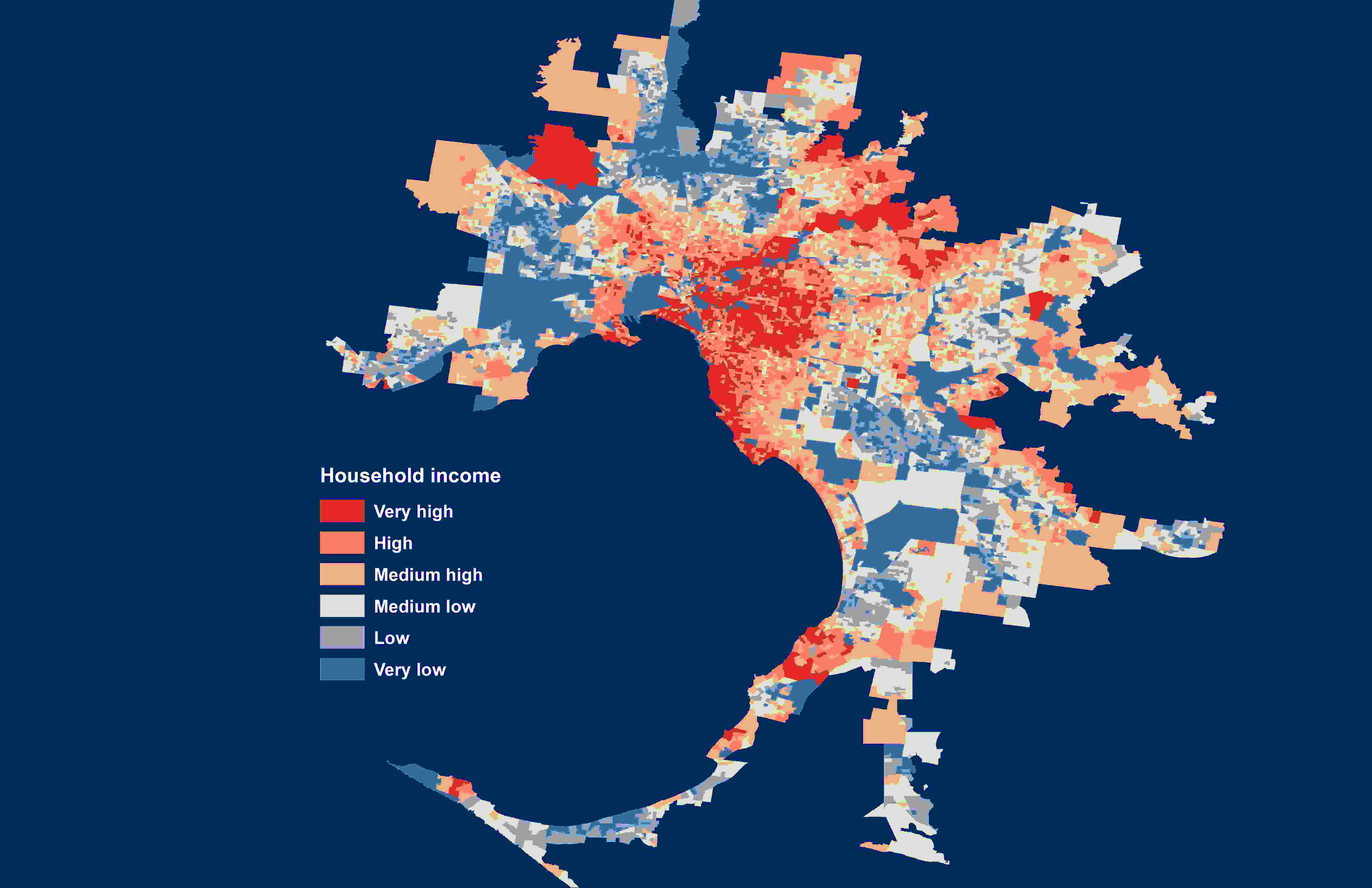

In the short term the best response is income assistance, targeted to those who need it most. In the longer term the best response is to reduce dependence on fossil fuels and increase household resilience through greater wage and income equity.

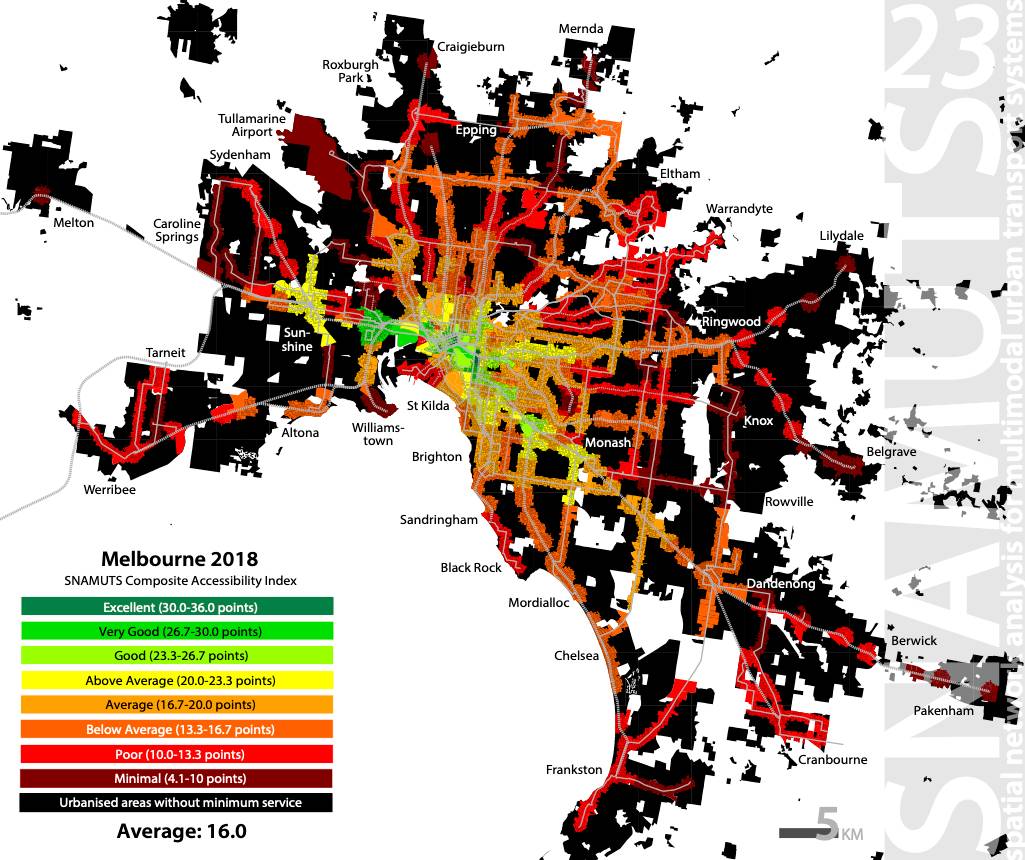

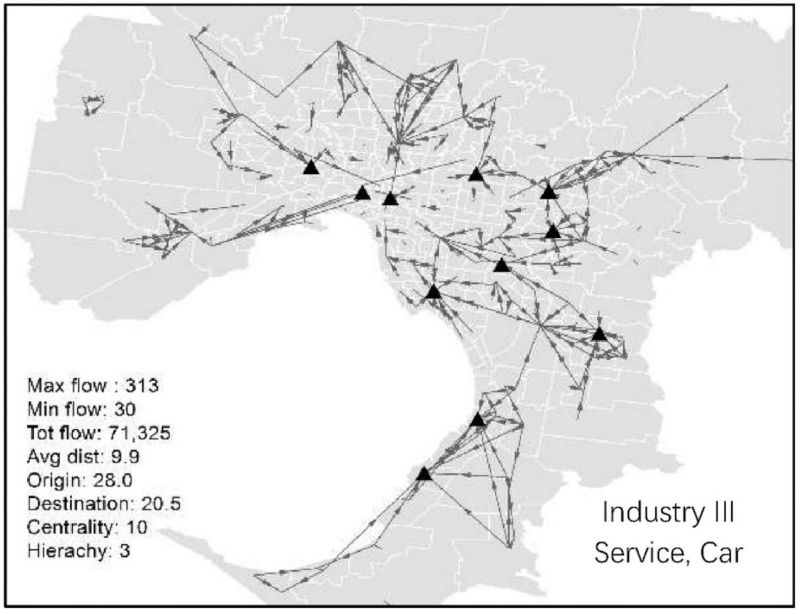

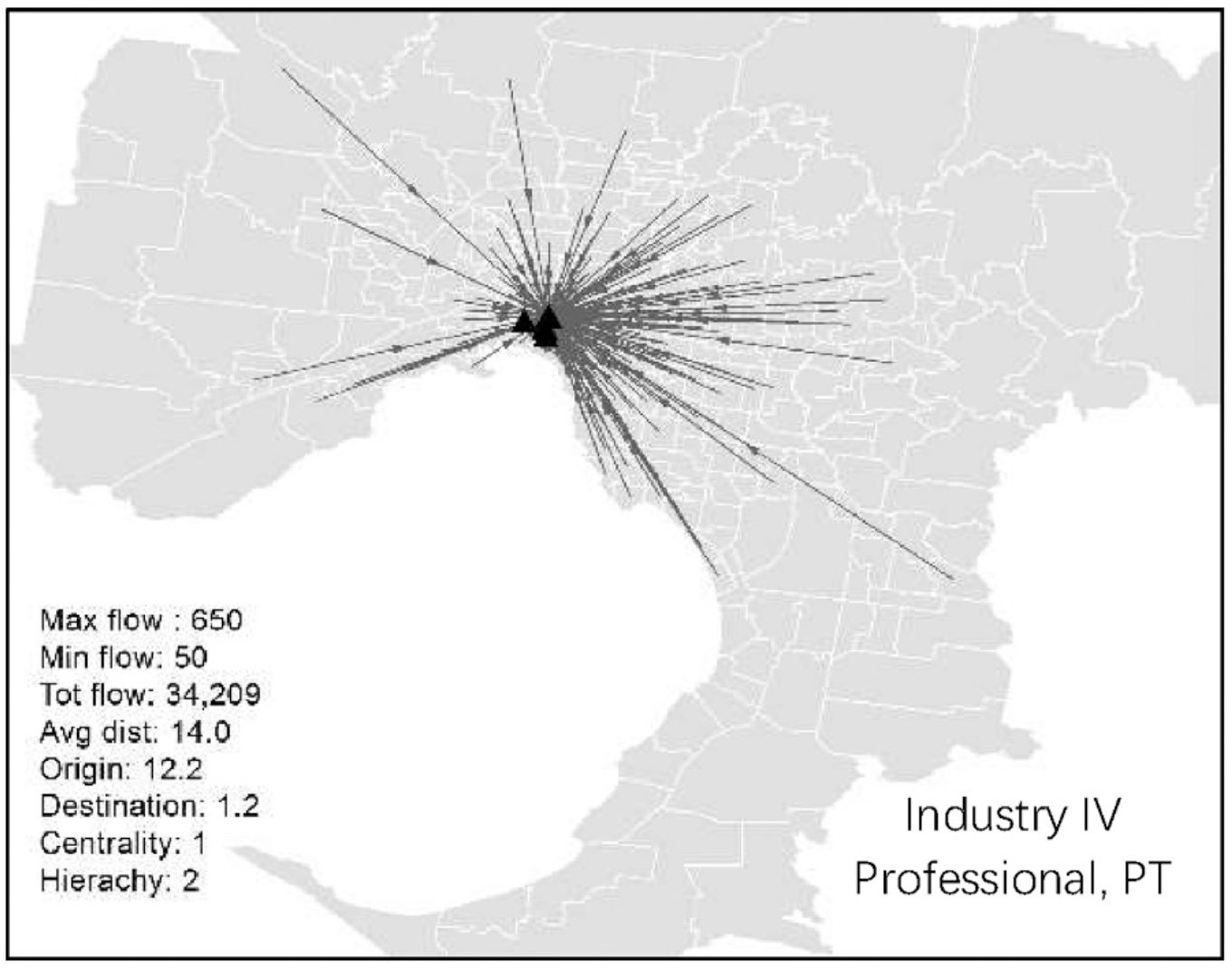

Making public transport cheaper is less important than providing better and more equitably distributed services. This could be funded by cancelling road projects that entrench automobile dependence – such as Melbourne’s A$16 billion North East Link toll tunnel project – and spending the money on outer suburban public transport upgrades.

Another change would be to ensure new suburbs are built with good public transport services at the outset. Currently, plans for new growth areas don’t require an accompanying integrated public transport network plan and rollout program. This should be mandatory so there’s public transport in new suburbs from the outset.

Measures could also include incentives to accelerate the transition to electric vehicles, but these also require care to ensure subsidies do not just benefit wealthier purchasers who can afford a new car while those on lower income driving older cars miss out.

While there’s a push now to slash the fuel excise duty, there’s a long term case for actually increasing it, based on international evidence showing higher fuel taxes do shift travel behaviour away from cars and reduce reliance on fossil fuels.

A generalised carbon price could have a similar affect and help drive down emissions. However, the regressive aspects of increased taxation would also need to be addressed through income measures and ensuring the extra revenue is used to improve public transport in oil-vulnerable suburbs.

Story: Jago Dodson, Professor of Urban Policy and Director, Centre for Urban Research, RMIT University, Tiebei (Terry) Li, Research Fellow, School of Global, Urban and Social Studies, RMIT University.

This article is republished from The Conversation under a Creative Commons license. Read the original article.