Reality Check: The United Australia Party promise to cap home loan interest rates

Can Clive Palmer and the United Australia Party make good on their promise to cap home loan interest rates at 3 per cent?

As the top policy item listed on the party’s website and blazed across yellow billboards and in TV advertisements, it’s a promise that has gone largely unchallenged.

Doubtless, it will be enticing for some homeowners – especially after the Reserve Bank of Australia warned it would be forced to push interest rates higher to curb inflationary pressures.

But is the UAP’s plan to set a ceiling on home mortgage rates feasible? And what would be the ramifications of a government-imposed cap on housing rates?

RMIT FactLab asked economists and an eminent election analyst what they thought about the UAP’s capped interest rate promise.

They variously described it as “nutty”, “incredibly naive”, “off the planet”, “crazy, crazy”, “a brain explosion”, and more.

Of course, assessing such a policy may well be academic: to be able to deliver on its promise, the UAP would have to govern in its own right or hold considerable sway in the new parliament by winning enough seats to hold the balance of power.

Recent opinion polls suggest the party has no prospect of achieving either outcome.

Please explain Pauline doesn't get it, but we do.

— Sean Conway - UAP 🇦🇺 ACT Bean Candidate (@seancondev) May 11, 2022

Save your home, Vote UAP#VoteUAP #auspol #AusPol2022 #Auspol22 #AusVotes #ACTPol pic.twitter.com/lvNde7yW0M

What is the UAP policy? Is it evidence-based?

The UAP has said that, if elected, it would legislate to cap home mortgage interest rates at 3 per cent, a rate that would be fixed for five years. The UAP boldly declares that the move would “save Australian home ownership”.

However, the policy lacks clarity. The UAP’s website refers to “all” home loans, yet UAP leader Craig Kelly narrowed that scope in an interview with The Daily Telegraph, outlining that the policy would only cover existing owner-occupier loans and not new or refinanced mortgages.

It is also unclear how the proposal would work in practice. Although Mr Kelly suggested the government could sell Treasury bonds and lend the funds raised to banks, one expert told FactLab the structure outlined by Mr Kelly indicated a misunderstanding of how the housing loan market – and financial markets more generally – operated in Australia.

The UAP laces its plan with rhetoric suggesting that should home lending rates exceed 4 per cent, “60 per cent of Australians will default on their mortgages and will lose their homes”; at 6 per cent, four in every five home loans would default. However, the party does not offer any evidence or data to support its claims.

Experts contacted by ABC Fact Check said they knew of no data that would support the UAP’s default claims.

Could a cap be imposed?

In theory, the federal government could set limits on the interest rates that banks charge on loans and deposits.

Interest rates on bank loans and deposits were capped in Australia up until as late as the 1980s, when economic developments and ideological shifts led to the deregulation of the economy and financial industry.

An extensive inquiry into the Australian financial system by the Campbell committee resulted in a blueprint for financial deregulation in 1981, including recommendations to remove all controls over interest rates.

At the time, caps on lending rates and deposit rates were among the tools used by governments to control monetary policy.

But the Campbell Inquiry found interest rate controls were “ineffective as a monetary policy instrument”, hampered competition and innovation, and led to funds being diverted to “possibly less efficient, unregulated” financial entities.

It found interest rate ceilings had unequal effects on customers, and low-income borrowers were “unlikely” to have benefitted from interest rate caps. The purported social and prudential benefits of capping lending rates were “not substantial – if they exist at all”.

The inquiry recommended abolishing direct interest rate controls and removing the power to impose direct interest rate controls as provided under section 50 of the Banking Act.

We will be paying an extra $1400 per month on our home loan when interest rates hit 6%. Thats extra money that we can't afford. Can you?

— United Australia (@UnitedAusParty) May 1, 2022

The @UnitedAusParty will cap interest rates at 3% for the next 5yrs to save your home and your livelihood.

Vote 1 United Australia Party. pic.twitter.com/Md59h012Lq

The impact of deregulation

Interest rate caps on various loan products were gradually removed from the early 1970s, but the ceiling on home loan rates stayed until 3 April 1986 when, after months of insisting it would not remove the interest cap, the Hawke government suddenly reversed its position.

The government’s move was precipitated by a deepening crisis in the housing industry. General interest rates were rising. As bank customers turned to NBFIs for higher rates on their savings accounts, savings banks were increasingly constrained in their ability to provide funds for housing.

Today, theoretically, a government could reintroduce interest rate regulation on authorised deposit-taking institutions (ADIs) either by reviving the historic but dormant section 50 provision of the Banking Act 1959, or perhaps by amending the Reserve Bank Act 1959. Section 50 of the Banking Act 1959 provides:

1) The Reserve Bank may, with the approval of the Treasurer, make regulations:

(a) making provision for or in relation to the control of rates of interest payable to or by ADIs, or to or by other persons in the course of any banking business carried on by them.

Either way, there would be serious ramifications for the Reserve Bank, both in terms of its independence and its ability to properly conduct monetary policy operations.

What the experts say

Rob Henderson is an independent markets and policy economist, a former chief economist at the National Australia Bank and was a policy adviser inside the Finance Department during the advent of deregulation in the 1980s.

He believes any move by a government to set or cap interest rates would amount to a major change in the management of monetary policy and would undermine the independence of the Reserve Bank (RBA).

“Effectively, you would be putting a brick wall in front of the RBA,” Mr Henderson said. “And it could put a huge brake on the Australian construction market because banks might be forced to curtail lending for new houses under this proposal.”

Because housing is such a big part of the Australian economy, any move by the Reserve Bank to lower its cash rate (thereby, easing monetary policy) tends to stimulate an increase in lending and, in turn, stirs housing construction activity. Conversely, lifting the cash rate tends to temper lending and curb economic activity.

Mr Henderson said any move by a government to control housing interest rates would cut across the Reserve Bank’s ability to indirectly manage broader economic demand.

He suggested that a government-imposed cap on interest rates would severely squeeze lenders’ operating margins in a rising interest rate environment, leading to the rationing of credit.

“It’s an incredibly naive policy,” he said. “It’s been put out there, not realising there are all these implications if you cap rates. It would cause a crash in the housing market because [people] would not be able to get a loan. It just displays a complete lack of understanding about how the markets operate.

“Banks were able to step up during the pandemic, and they kept lending through the GFC [global financial crisis] when banks overseas didn’t. You don’t want to go and muck around with this system where you completely gum it up. It would throw an enormous spanner in the Australian economy.”

Australia has capped mortgage interest rates in the past, but these three economists say there are very good reasons why that stopped in the 80s: https://t.co/Aa09aqlMQG #auspol #ausvotes #ausecon pic.twitter.com/XbPCXrxKgo

— Michael Janda (@mikejanda) May 11, 2022

Potential negative impacts on the market

Professor Kevin Davis is a specialist in finance and bank lending. He has been a professor of finance at Melbourne University since 1987, a part-time board member of the Australian Competition Tribunal since 2011, and was a member of the 2013-14 Financial System Inquiry.

Professor Davis said while it would be possible for a government to pass legislation capping interest rates, doing so would cause banks to ration credit.

“Putting ceilings on loan interest rates leads banks to ration credit, and those squeezed out are generally the poorer and less credit-worthy,” he explained.

Those people struggling to obtain loans from banks would be forced to seek home loans or extra funds from unregulated lenders. In other words, low-income borrowers would be driven into higher-priced, riskier loans.

Professor Davis suggested that although deposit rates were “minuscule” now, that would change as interest rates increased overall. And, because capping the amount banks could receive from loans would affect the amount paid on deposits, the banks’ ability to lend funds would be constrained.

Saul Eslake, an independent economist and consultant at Corinna Economic Advisory and former chief economist at ANZ Bank, echoed the comments of Professor Davis, adding that a rates cap would cause the supply of mortgage finance to dry up.

“Indeed, this used to happen when there was a regulated ceiling on the mortgage rate,” he said. “Once the cost of funding mortgages rose to the point where it was no longer profitable for banks to lend at the regulated ceiling, banks would start ‘rationing’ credit.”

When that happened, banks would cut the maximum amount they were prepared to lend customers, or offer them “cocktail loans”. These comprised a small home loan at the regulatory ceiling rate, plus a personal loan at a much higher, and unregulated, rate.

Tim Lawless is the research director of Corelogic Australia, one of the leading independent organisations providing data and analysis of the Australian property market.

He said the UAP’s policy proposal was “just a complete brain explosion” that, if implemented, would have the counterproductive effect of making home loans easier for wealthy people to access while excluding those on lower incomes.

“And what happens after five years, when the ceiling is removed? You’d have a massive refinancing across the industry, and anyone who is enjoying fixed rates would go through a rapid adjustment.”

Save Your Home. Save Your Home. #AusPol2022 pic.twitter.com/BnhJn8FQHN

— United Australia (@UnitedAusParty) May 4, 2022

Default rates

None of the experts contacted by Fact Check could find any justification for the UAP’s claim that 60 per cent of home loans would default if mortgage rates hit 4 per cent.

Banks and other home lenders have a range of measures they can apply to ease pressure on mortgage holders long before a property is repossessed. These measures include extending a loan’s repayment period.

Mr Lawless noted the impairment rate on mortgages in Australia is traditionally very low.

Data compiled by the Australian Prudential Regulation Authority indicates that in the latter half of 2019, only about 0.9 per cent of all housing loans (by value) were 90 days or more in arrears.

From the outset of the pandemic in early 2020, banks and other lenders provided extensive hardship arrangements, which ensured home loan default rates remained low. More recent APRA data indicates this rate of impairment only got as high as 1.1 per cent of total housing credit outstanding and is now around 0.8 per cent.

“It’s perhaps worth noting that, historically, mortgage default rates in Australia are very low, even during periods of high interest rates,” Mr Eslake said. “That’s partly because banks and other lenders are, despite their image, genuinely reluctant to foreclose on mortgages.

“They will go to considerable lengths to help distressed borrowers restructure their payment schedules in order to avoid default, provided that borrowers in distress approach their lenders promptly once they find themselves in serious mortgage stress – and provided they are honest about their circumstances.”

Mr Henderson said: “Even if the economy is turning to custard, customers keep paying their mortgages.”

So, what are the chances of the UAP pulling this off?

Winning the balance of power on Saturday might allow the UAP to press the incoming government into adopting its rate cap policy. But that prospect appears extremely remote.

Polling and political analyst Dr Kevin Bonham, of the University of Tasmania, doubts the United Australia Party can win more than one Senate seat based on the most recent opinion polls.

“Most House of Reps polling has had the UAP on 3 to 4 per cent, similar to or slightly higher than their 2019 result and below their 2013 result as Palmer United,” he told FactLab.

One poll by Resolve Strategic has put the UAP vote at 5 per cent, while Roy Morgan polls have generally recorded support of below 2 per cent.

“On all these levels of support, the UAP would not have realistic chances of winning any House of Representatives seat with the possible exception of the NSW seat of Hughes,” he said.

Some polls of specific seats have put UAP support as high as the mid-teens, but not high enough to put the candidate in a winning position.

“I would expect the UAP's Senate vote share to be similar to its Reps vote share this year,” Dr Bonham added. “The UAP is not likely to poll anywhere near a Senate quota in any state.”

Save your homes (or foreign investors will!) #UAP #1UAP https://t.co/p11rlPlLFA

— Linda Daniel - UAP Candidate for Mitchell (@LindaDa93314230) May 16, 2022

Ad metrics

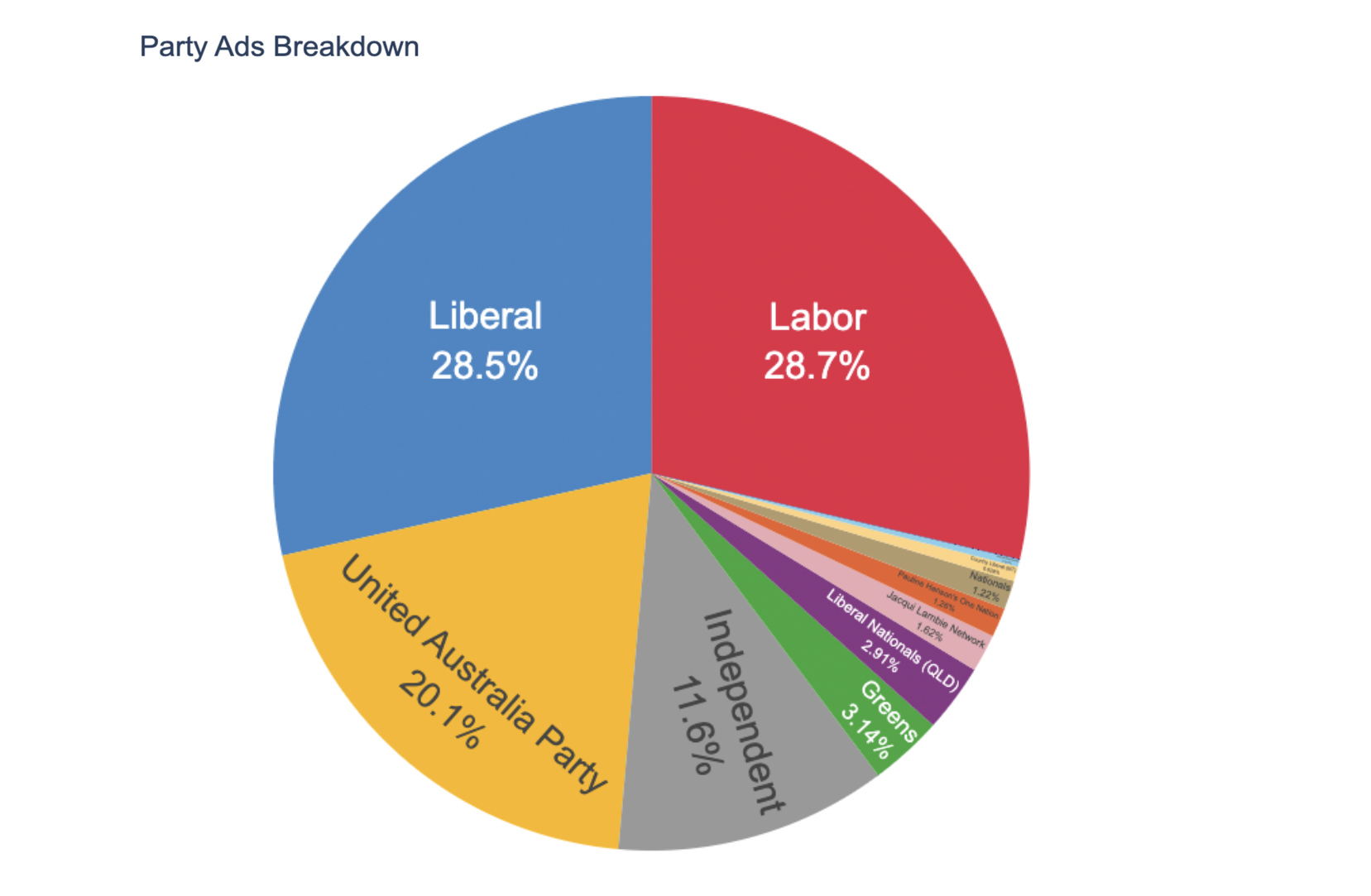

According to Queensland University of Technology’s PoliDashboard Facebook Political Ads Module, UAP has spent between $901,600 and $1.07 million on Facebook ads since January 1, which received more than 25.75 million impressions.

According to Meta’s ad library, the UAP spent $140,191 in one week on Facebook adverts between May 6 - 12, 2022.

Several UAP Facebook ads have recorded over 1 million impressions.

The offending advert on home loan interests, ran for nine days (5 - 13 May) and recorded between 1 and 10 million impressions.

According to the dashboard, the top five political advertisers on Facebook since January 2022 regarding minimum spend are: Labor Party ($615,700), Liberal Party ($612,300), United Australia Party ($431,000), Independents ($249,000) and the Greens ($67,500).

Google and YouTube

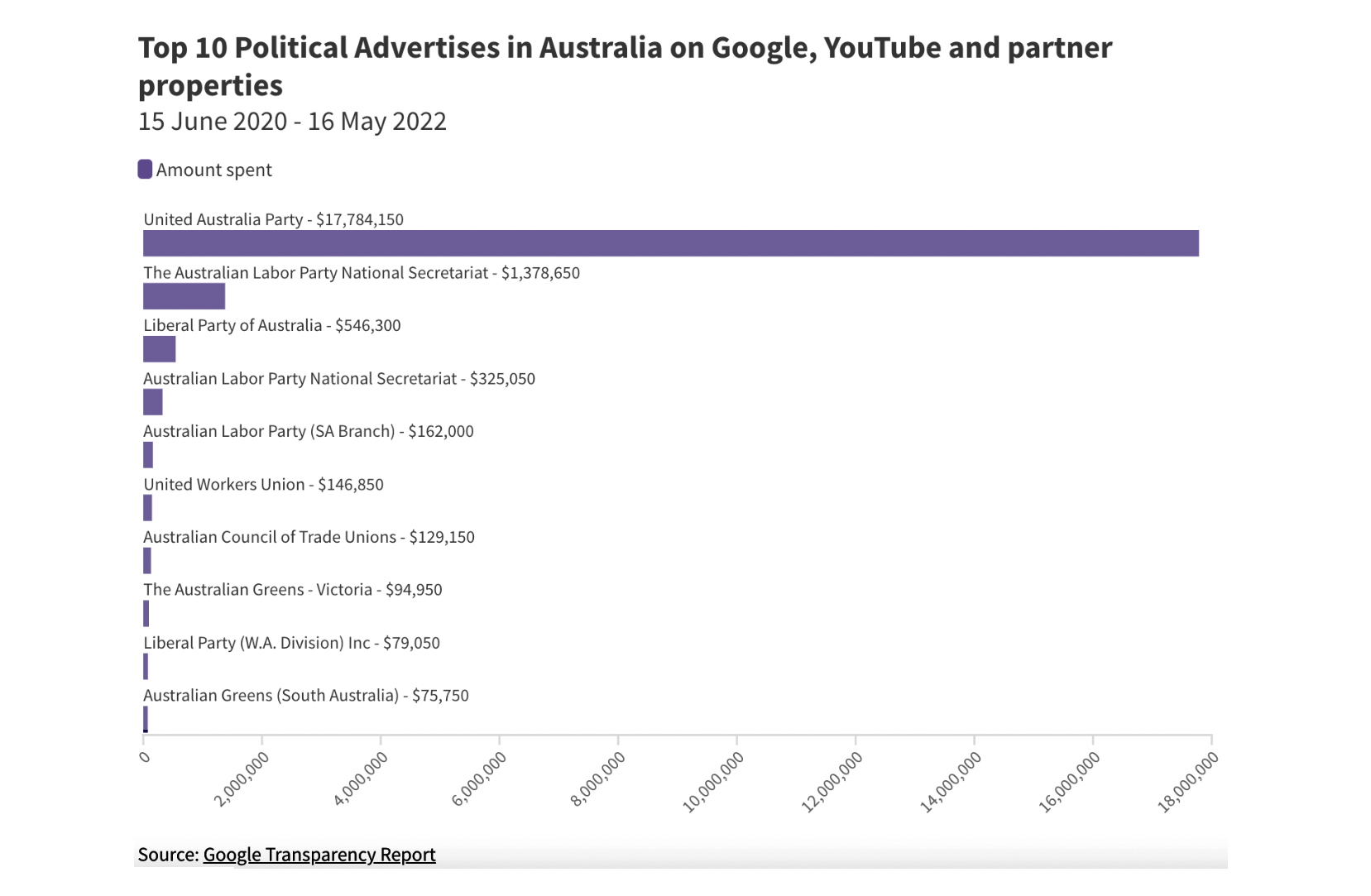

According to the Google Transparency Report, spending on political advertising on Google, YouTube and partners in Australia since November 15, 2020, has surpassed $22 million, with a total of 7,809 ads.

The UAP is the largest spender on political advertising in Australia on Google, YouTube and partner properties.

According to the Google Transparency Report for Political Advertising in Australia that records election ad spending on Google, Youtube and partners, the UAP has spent more than $17 million on adverts since January 1, 2022.

Acknowledgement of Country

RMIT University acknowledges the people of the Woi wurrung and Boon wurrung language groups of the eastern Kulin Nation on whose unceded lands we conduct the business of the University. RMIT University respectfully acknowledges their Ancestors and Elders, past and present. RMIT also acknowledges the Traditional Custodians and their Ancestors of the lands and waters across Australia where we conduct our business - Artwork 'Sentient' by Hollie Johnson, Gunaikurnai and Monero Ngarigo.

More information