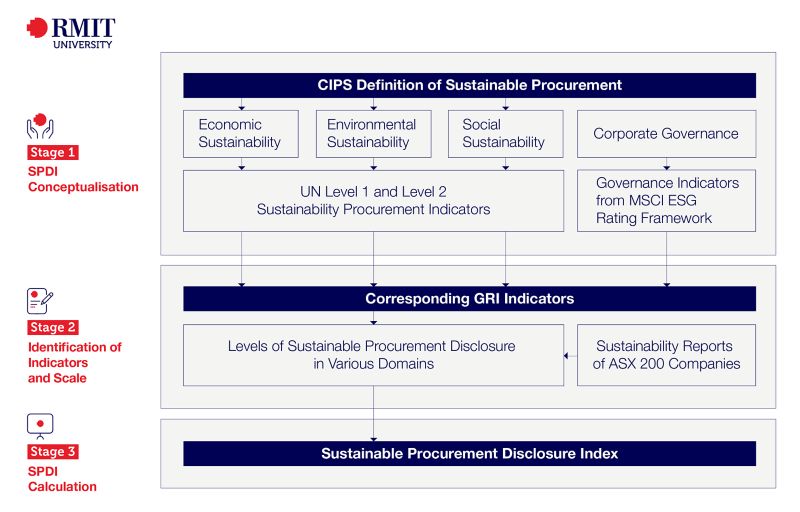

The methodological framework the project team have used consists of a sustainable procurment disclosure indexing and rating schema, which has been empirically demonstrated using a sample of 182 ASX 200 companies in 2023.* The team's intention is that this rating will empower the public to assess the transparency of businesses in disclosing their ethical and sustainable sourcing and supplier selection practices, based on globally accepted norms and standards for business conduct. The methodology has been designed to promote the generalisability and interoperability of the proposed SPDI. To achieve this, the team has utilised widely accepted industry standards to create a generic, objective, replicable, and transparent methodology that is relatively straightforward to compile, scrutinise, and interpret.

*Within the ASX 200 list, some entries are mutual or exchange-traded funds affiliated with financial institutions such as major banks. These financial institutions can have multiple funds listed in ASX 200 but a single sustainability report. As such, only 182 companies are available with data in 2023 for compiling the index.

Guided by the broader definition of CIPS on SP, environmental, social, economic criteria of sustainable development, along with the dimension of corporate governance, are identified as essentials for the SPDI. This study uses some of the SP indicators developed by the UN to design the SPDI. For the UN indicator set, there are 12 Level 1 indicators, which represent the criteria of the three dimensions of sustainable development. For each Level 1 indicator, there can be one or more Level 2 indicators, each addressing a specific aspect of the criterion. Table 1 shows the Level 2 UN indicators selected for creating the proposed SP framework. Meanwhile, utilising the widely recognised MSCI ESG Indexes as a reference, governance dimension within the SP framework is defined. Table 2 presents the governance criteria integrated into the SP framework.

Economic Domain |

Social Domain |

Environmental Domain |

SRU1 |

SRU2 |

POP1 |

SRU3 |

HR&LI1 |

POP2 |

WLCC1 |

HR&LI2

|

CCM&A1 |

LC&SME1 |

HR&LI3 |

CCM&A2 |

PSTSC1 |

HR&LI4 |

CCM&A3 |

|

LC&SME2 |

|

UN SP Indicators Used: Climate change mitigation and adaptation (CCM&A); Human rights and labour issues (HR&LI); Local communities and SMEs (LC&SME); Prevention of pollution (POP); Promoting sustainability throughout the supply chain (PSTSC); Sustainable resource use (SRU); Whole life cycle cost (WLCC)

Indicators |

Sub-indicators |

Board independence |

|

Board diversity |

|

Structure |

|

Audits and internal controls |

|

Stakeholder engagement |

|

Transparency |

|

Selecting the corresponding GRI indicators for SP and governance indicators to establish a comprehensive template is critical to this stage. The relevant GRI indicators (32 in total) in the 2023 dataset are assessed based on the coding framework as follows:

Sustainability reports of the ASX 200 companies are reviewed using the coding framework to compute the level of disclosures of SP and governance indicators.

To enhance the granularity of reporting and align with the 5-star rating system (see below), the project team revised the 3-point coding scheme (0–2) used in 2023 to a 5-point scheme (0–4) in 2024, as detailed below:

NOTE: The 5-point coding scheme used in 2024 is backward compatible, allowing results to be easily collapsed into the 3-point scale used in 2023 for easy comparison of the two datasets.

An unweighted approach is used to calculate the SPDI. By averaging the GRI values within each domain and overall, the level of disclosure in the four areas related to SP and the overall level of disclosure of each sampled ASX company can be determined. A five-star rating system shown in Table 3 is employed to categorise companies according to the extent of their disclosure in SP practices.

Rating |

Level of Extensiveness of Disclosure in SP Practices |

Scope of Reporting |

★★★★★ |

Most Extensive |

All or most of the 32 GRI reported (81 – 100%) |

★★★★ |

Extensive |

Many of the 32 GRI reported (61% – 80%) |

★★★ |

Moderately Extensive |

About half of the 32 GRI reported (41 – 60%) |

★★ |

Partially Extensive |

Some of the 32 GRI reported (21 – 40%) |

★ |

Least Extensive |

None or only a few of the 32 GRI reported (0 – 20%) |

Research is ongoing to develop sector-specific SPDIs and to validate disclosures through third-party accreditation. Further details are available on the Boarder Insights page.

RMIT University acknowledges the people of the Woi wurrung and Boon wurrung language groups of the eastern Kulin Nation on whose unceded lands we conduct the business of the University. RMIT University respectfully acknowledges their Ancestors and Elders, past and present. RMIT also acknowledges the Traditional Custodians and their Ancestors of the lands and waters across Australia where we conduct our business - Artwork 'Sentient' by Hollie Johnson, Gunaikurnai and Monero Ngarigo.

Learn more about our commitment to Indigenous cultures